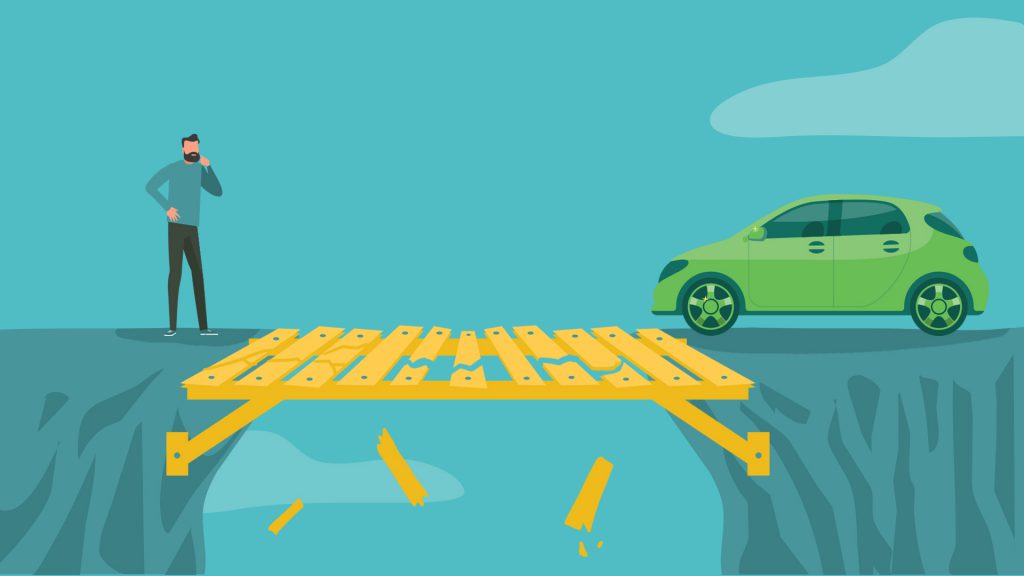

When you realize that the mountain of debt you’re facing for whatever reason is way more than you’ll ever be able to handle, filing for bankruptcy offers you a way out. In a Chapter 13 bankruptcy, you’ll work with an attorney and the bankruptcy court to come up with a reasonable payment plan that will get your debts back under control – something that can take anywhere from 3-5 years to achieve. In a Chapter 7 bankruptcy, all your worst debts are completely eliminated, leaving you with only those you need to maintain (such as your house, car, and student loans). The decision to file and the process of filing for bankruptcy causes a lot of stress for most people going through it. If they discover they need to replace their car, the added stress causes many people to make one or more of the 10 bankruptcy car buying mistakes. This article explains each one, and how you can avoid all of them.

1. Paying Cash for a Car

People with fantastic credit who can pay for a car in cash should always feel free to do so and avoid all the interest payments of a financed purchase. But if you are in a bankruptcy situation, we think paying cash for a car is one of the worst bankruptcy car buying mistakes you can make. Why? Because one of your primary goals in filing bankruptcy is to start rebuilding your credit history and increase your credit score.

What the credit bureaus are looking for is how you how handle new lines of credit. If you pay cash for a car, nothing gets reported to the credit bureaus, which means you won’t gain any credit-improving benefits! One way to start restoring your credit is by financing the purchase of a vehicle and making on-time payments, each of which will be reported to the credit bureaus.

Although the costs of the loan mean you’ll end up paying more than you would with cash, it can be worth it in order to improve your credit score. You’ll end up having more credit options available to you for other kinds of loans like a mortgage to buy a house, a home equity loan to make improvements to your house, and qualify for better credit cards. Can you afford to miss out on all those benefits? Day One Credit has a strong network of lenders who specialize in serving bankruptcy customers, whether it’s a Chapter 7, a Chapter 13, or a recently discharged bankruptcy.

2. Buying from an Unreputable BHPH Dealer

What is a BHPH dealer? It’s an acronym standing for “Buy-Here-Pay-Here car.” This kind of car dealership offers what some people call “in-house financing.” It means the dealer is not only selling you the car, it is also loaning you the money to make the purchase. This can turn out to be one of the most serious bankruptcy car buying mistakes! If you’re not sure whether or not a dealer is a BHPH, one sign is that they almost always guarantee approval

The problem is that the terms of the loan might be really horrible. We’ve heard that some BHPH dealers are notorious for taking advantage of credit-challenged people by charging grossly high interest rates. Then, to add insult to injury, they often hide all kinds of fees and other inconvenient terms in the fine print of the finance contract. For example, the contract might specify that you have to make weekly payments instead of monthly payments, and if you’re late on just one payment they will repossess the car! No one should settle for those kinds of shady practices.

At Day One Credit, we don’t make loans, we find loans. We send your application out to all the lenders in our network who have special programs for bankruptcy customers. These lenders are competing for your business, which means you’ll end up with the loan that fits your particular credit situation.

3. Purchasing an Older Car with High Miles

When bankruptcy filers assume there’s no way they could ever get approved for a car loan, they often end up trying to spend as little as possible on a car they can buy for whatever little cash they have. What they end up being able to afford without financing is often an older car with a whole lot of miles on it that’s not in the best of shape. But here’s the thing: When you settle for an older vehicle with high miles, you often end up paying a lot more in repairs than you thought you would. If you add all those repair costs to what you’ve already paid for the car, you might realize you would have been better off paying a higher price on a newer used vehicle with fewer miles that doesn’t need to constantly be in the repair shop.

Other kinds of cars you should avoid at all costs are those with salvage titles and those that are clearly lemons. Cars with prices that seem too good to be true are probably exactly that. If you shop the bottom of the barrel, you inevitably get what you pay for, and then some in the form of hidden frame damage, flood damage or all kinds of other safety issues that will cost you way more than you bargained for. Financing a better used car will save you money in the long run, as well as help your rebuilt your credit.

4. Getting a Brand-New Vehicle Instead of Used Vehicle

When you’re in an open or recently discharged bankruptcy situation, you need to make smart choices in order to make the most of the fresh start bankruptcy provides. The smart choice here is to get the most bang for your buck as possible, which makes buying new one of the most common bankruptcy car buying mistakes people make. Why is purchasing a brand-new vehicle a bad idea? The reason is because of the depreciation factor. In the first several years your new car loses 15-25% of its value each year, which means you’ll be “underwater” or “upside-down” on the loan for years. But if you buy a high-quality used vehicle, the previous owner has already taken the big hit on depreciation, which means you get a great car for a lot less money!

5. Choosing an Unaffordable Vehicle such as a Luxury Car

This one is a variation on making responsible choices as a bankruptcy car buyer. Can you really afford a luxury car? Would it be a stretch to afford it? What will you do if something changes and your income goes down? At Day One Credit, we help people be realistic about what they can afford. After all, the last thing you want to happen when you’re trying to rebuild your credit is bite off more than you can chew and end up being delinquent on your car payments. What many people don’t realize is that there are more costs to owning a luxury car than just the price tag and monthly payment. Luxury cars cost a lot more to insure, and they’re also going to cost more to maintain and repair when something goes wrong.

6. Failing to get GAP Insurance and Service Contracts

What is GAP insurance? This is an acronym that stands for Guaranteed Asset Protection. It’s a type of insurance that covers any “gap” between the balance of a loan due on a vehicle and what an insurance company pays in the event of a total loss. In case you didn’t know, those two figures rarely match up. The insurance company often pays less for the car than what you still owe on it. No one likes being stuck with payments on a car that no longer exists, and GAP insurance is what protects you from that scenario. Service contracts are another kind of insurance that help pay for maintenance and repairs when needed. Please note that service contracts vary widely in terms of what is covered, for how long, and with what kind of deductible you have to pay. Read the fine print before signing on the dotted line!

7. Replacing a Great Car

You would be surprised how many people in a bankruptcy situation make the mistake of getting a different car when they don’t even need one to being with. Yes, you want to rebuild your credit, and financing a car purchase is one way to do that, but it should never be your only reason to do it, and especially if you already have a great car. Here’s what Day One Credit offers as a rule of thumb in this situation: If your current car is less than five years old, has relatively low mileage, and is paid off or close to being paid off, you should definitely stick with it! There are other ways to start rebuilding your credit, such as getting a secured credit card.

8. Buying a Car for Someone Else

Whether it’s your child, another family member, or a friend, buying a car for someone else may be a very generous thing to do, but often ends up being one of the worst bankruptcy car buying mistakes you can make. Remember, your top priority with a bankruptcy is to get your credit back into good shape. But when you buy a car for someone else, can you guess who is on the hook if something goes wrong? The answer is YOU! When you’re trying to restore your credit, the last thing you should do is become the one who is ultimately financially responsible for someone else’s vehicle no matter how responsible you think they are.

9. Having a Cosigner Who did Not Also File for Bankruptcy

You have to be very careful to understand the situation you have with your current car and its outstanding loan if you decide to declare bankruptcy but had a cosigner on the loan. If you declare bankruptcy but your cosigner doesn’t, the lender can (and probably will) go after your cosigner to collect on the remaining debt. This can cause a great deal of pain and heartache between two people, so be sure you know the details of your current situation. Day One Credit is always happy to help you understand all your options – just contact us!

10. Lacking a Valid License

Most lenders are going to require that your driver’s license be valid, up-to-date, and not suspended. You should not try to get a car at all if you lack a valid driver’s license because it could land you in some serious trouble. Don’t do it!

If you’re in a bankruptcy situation and you need a car, you won’t find a better option in the greater San Diego area than Day One Credit. Read our Why Day One page and see for yourself!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.