Filing for bankruptcy is a big step, but one that will ultimately help you get your debt under control so you can make a fresh start and move forward. But what happens if you file bankruptcy and then realize you have to replace your car? You might go to one of your local car dealerships, only to find out they can’t or won’t help you get the car you need as some dealers do not work with bankruptcy filers. Why do some dealerships avoid bankruptcy customers? This article will explain why, as well as what you can do to still get the car you need even when you’re in the midst of a bankruptcy.

Reason #1: Few Lenders Willing to Finance Bankruptcy Customers

The first thing to understand is that there really aren’t that many lenders who are willing to make car loans (or any kind of loan, for that matter) to people with an open or recently discharged bankruptcy. Why is this the case?

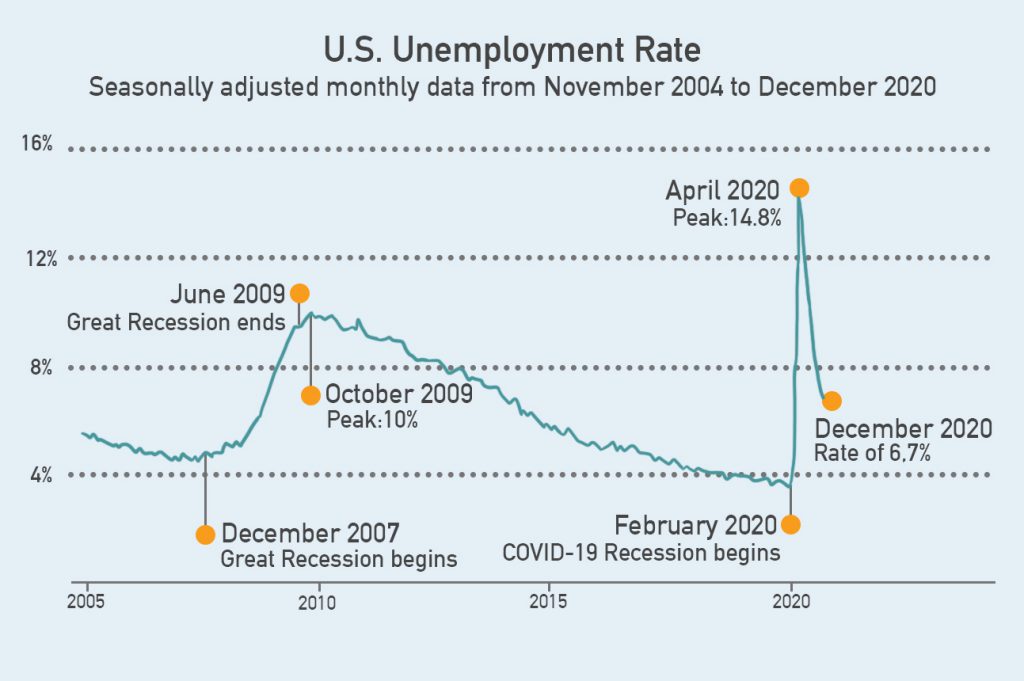

Many lenders like to restrict their loans to people who have a great credit score and solid credit history of making payments on time. They make money on these loans by charging interest and fees for making money available to you to buy a car. In other words, they want to get their money back, and then some. People with great credit are the ones who are most likely to repay their loans. The better their credit, the less likely they will default on the loan. They represent the lowest possible risk of the lender losing any money.

Another way of putting this is that some lenders are “risk-averse,” meaning they don’t want to take a risk by working with bankruptcy customers. The lenders see bankruptcy customers as a higher-risk group of people who are more likely to encounter difficulty in repaying their loan. They simply don’t want to take the risk. When they look at a bankruptcy customer, they see someone who has failed. They see a glass that’s half-empty, to borrow a well-used metaphor.

This is a shame, really, because the whole point of filing bankruptcy is to give you a way to get your financial life back in order. The good news is that there are lenders out there who look at a bankruptcy customer and see a glass that’s half-full. They understand that filing bankruptcy is a positive step to reduce or eliminate your worst debts so you can get back on your feet. These are the lenders who have fresh start car loan programs and are willing to work with bankruptcy customers. Yes, it will cost you more in terms of higher interest rates to get a bankruptcy car loan, but that is understandable since the bankruptcy lender is taking on a higher level of risk by lending to you.

Although it would be nice if there were more lenders willing to work with bankruptcy filers, the reality is that it remains a limited pool of companies. Some dealerships avoid bankruptcy customers because there simply aren’t that many lenders they can work with, and it takes time and effort to develop relationships with those lenders. For many dealerships, it just doesn’t feel like it’s worth the time and effort to try and make this happen.

Reason #2: A Small Market Means Some Dealerships Avoid Bankruptcy Customers

An additional reality to layer on top of the lack of lenders who are willing to work with bankruptcy customers is how in most places, bankruptcy filers who need to finance a car purchase represent a small, niche market. In smaller communities, there really aren’t very many people filing for bankruptcy, and not all of them need to finance a car purchase. When you get down to this level of segmenting an audience for marketing purposes in smaller cities and towns, there simply aren’t enough people to justify the time and effort a dealership would have to make in order to set up the relationships with lenders (that are already scarce) and to conduct marketing activities to try and reach those few people. This is unfortunate if you’re a person declaring bankruptcy in a smaller place and need to replace your car because your community’s dealerships may avoid bankruptcy customers.

But this often situation changes when it comes to larger cities and major metropolitan areas. The market of people filing bankruptcy who need to finance a car purchase becomes big enough that some dealerships see an opportunity to serve a group of people who otherwise will be left out of the process altogether.

Reason #3: Lack of Experience is Another Reason Dealerships Avoid Bankruptcy Customers

Even when you’re in a major metropolitan area, though, you still have the situation where some dealerships avoid bankruptcy customers for the simple reason that they lack the experience needed to do it. If a dealership’s experience is mostly working with customers who already have great credit, the idea of learning how to work with bankruptcy customers is a big step. They need to understand the ins and outs of bankruptcy laws and how the process works in order to serve bankruptcy customers.

This is important because people filing bankruptcy or who are considering bankruptcy often don’t know much about the process or what their options are. When they also realize they need a car, they will have lots of questions not just about how they can get a car, but about bankruptcy in general. In other words, there is a certain level of expertise needed in order to serve the needs of bankruptcy filers. Many dealerships simply don’t have the expertise or experience.

At Day One Credit, we’ve been working exclusively with bankruptcy customers for years. We’re familiar with many different common questions and concerns people have when declaring bankruptcy and how to finance a car purchase in spite of a bankruptcy.

Reason #4: It’s Difficult and Costly to Market to Bankruptcy Customers

One final reason why some dealerships avoid bankruptcy customers is that marketing to them as a group is both difficult and costly. A lot of people in the midst of bankruptcy just assume there’s no way they could finance a car purchase, so they try to keep their current car going if they can, or rely on the help of family and friends for rides, or try to get by on public transportation even when it’s impractical and inconvenient. How can a dealership that is willing to work with bankruptcy customers reach them to let them know there are options available to them such as a bankruptcy car loan?

Because filing bankruptcy is a federal court proceeding, there is a public record in the public domain about your filing. Anyone can access these public records through a system called PACER, though very few do it. But a company that does provide services to bankruptcy filers can pay a fee (typically 8 cents/record) to access these records, including the mailing address of anyone who has filed for bankruptcy. One way to reach these potential bankruptcy car loan customers is through direct mailers. That is why most bankruptcy filers receive so much mail after filing for bankruptcy. These mailers are quite costly for advertisers. Besides paying for each record from PACER, there are then all the costs to design the direct mailer, have it printed, and then mailed out to bankruptcy filers. The expense of this kind of marketing campaign is substantial, and the results are often not very good, often being 1% or less for many campaigns. The difficulty and expense of marketing to this group of consumers is another reason why so many dealerships avoid bankruptcy customers.

At Day One Credit, we are devoted to serving customers who need to finance a car purchase even though they have an open Chapter 7, an open Chapter 13, or a recently discharged bankruptcy. Discover more about how it works, read customer reviews, reach out through our contact us page if you have questions, or feel free to apply now!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.