No one wants to declare bankruptcy. There’s a good deal of stigma attached to it. It’s stressful, and even more so when people make you feel like filing bankruptcy is some kind of failure. While it’s true that some people find their way into bankruptcy because of bad choices and poor spending habits, there are many more who have to file through no fault of their own. In fact, the most common reason people declare bankruptcy is because of an illness or accident that leaves them with staggering medical bills they will never be able to pay. Health insurance is great, but it doesn’t always cover everything, and the costs of medical care continue to spiral out of control. Now imagine how you’ll feel if you file for bankruptcy and then discover you need to replace your car as well. More stress! But this is when you need to find out about the 10 Bankruptcy Car Loan Benefits.

General Bankruptcy Car Loan Benefits

There are several bankruptcy car loan benefits that can be gained from any provider who serves up loans to people with challenged credit, including the following:

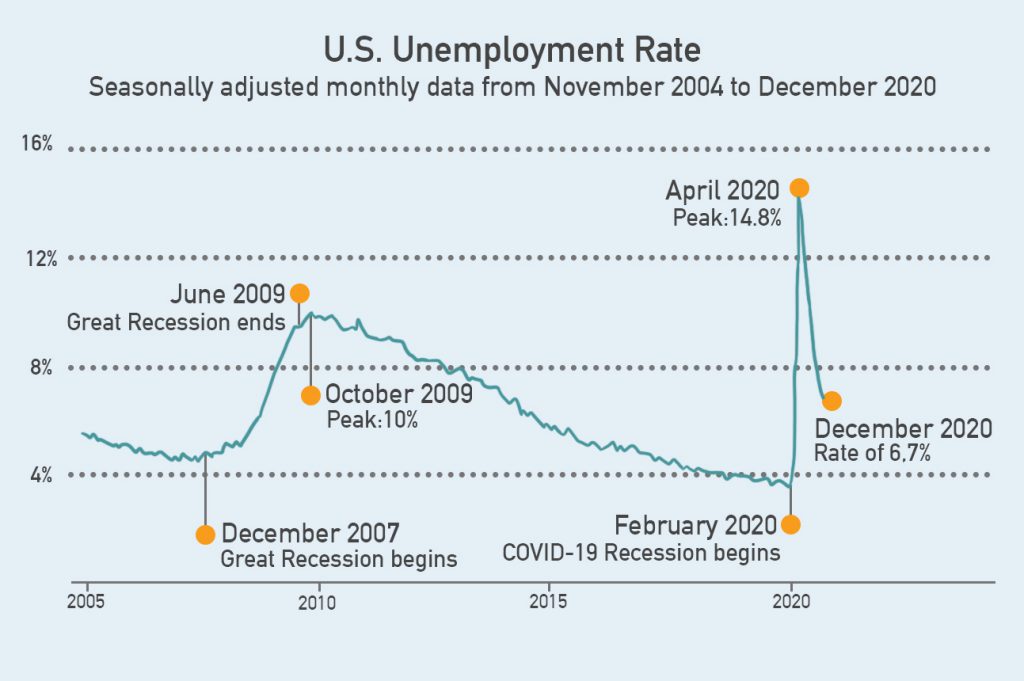

Improve Your Credit Score. When you realize filing for bankruptcy is the only way you’ll be able to get your debts under control, your credit score will probably be as low as it’s ever been. And then you find out that the bankruptcy will be on your credit reports for at least 7-10 years for other lenders to see. How will you ever get a new line of credit if you need one? But the moment you file is when you have the opportunity to start rebuilding your credit history and moving your credit score up instead of down. There are lenders who recognize that filing bankruptcy is a positive thing. It will either result in your worst debts being totally eliminated (Chapter 7 bankruptcy) or create a reasonable repayment plan that will get you back on your feet (Chapter 13 bankruptcy). Financing the purchase of used car with one of these lenders offers you the opportunity to show the credit bureaus how you can make on-time payments on a new line of credit. This is how you get your credit score moving in the right direction!

Get Out of a Bad Loan. Lots of people in a bankruptcy situation feel trapped by an “underwater” or “upside-down” car loan, meaning they owe more on the vehicle than it’s worth. One of the best potential bankruptcy car loan benefits is the opportunity to get out of the underwater loan and get into a great used car you can actually afford.

Upgrade Your Ride. Other people who have filed for bankruptcy or had one recently discharged are struggling to keep their older car with lots of miles on the road because it keeps needing more repairs, which add up to be quite expensive over time. You may be able to use a bankruptcy car loan to drive a better car with fewer miles on it in good enough shape that it will actually cost you less in the long run!

Better Loan Rates. You might think that being in a bankruptcy situation automatically means you’ll have to settle for the highest interest rates out there on a used car loan. Not necessarily! People who have a horrible credit score who haven’t declared bankruptcy often get the worst rates of all. Why? Because as previously mentioned, the lenders who specialize in serving bankruptcy customers realize that declaring bankruptcy is a sign you’re taking action to improve your situation. When some of your worst debts are wiped away or part of a reasonable repayment plan, your debt-to-income ratio goes down, and bankruptcy lenders may reward you for that with better rates than people with bad credit who haven’t filed. Their debt-to-income ratio is higher and they have no prospects of improvement.

Why Day One Credit

There are eight more bankruptcy car loan benefits you can gain if you choose to work with Day One Credit to find financing, including the following:

Deep Experience. Day One Credit was founded by the same people who started the Auto City used car dealership in El Cajon more than a decade. Working with bankruptcy customers to find the financing they need has been a part of the core mission of this team from the very beginning.

Robust Network of Lenders. We’ve spent years putting together the most incredible network of lenders you can imagine. The lenders we work with have special programs to serve bankruptcy customers of all kinds. When we get all these lenders competing for your business at the same time, you end up with the rates and terms that fit your credit situation.

Affordability. We help many of our customers find bankruptcy car loans that don’t require any down payment at all. Of course, if you’re able to make a down payment, you definitely should. But if you can’t make a down payment, that doesn’t have to keep you from getting the loan and car you need. We’ll also help you make sure you end up with a car and loan you can afford. It doesn’t do any good if you stretch yourself too far and end up delinquent on your payments.

Trusted. The good work we have done on behalf of our bankruptcy customers has not gone unnoticed. Needless to say, our customers are super-appreciative of the results we get for them, as well as our excellence in customer service. We treat each and every customer like a VIP!

Know-How. Because we’ve been doing this work for so long, we know all the common questions people tend to ask, and we are always ready to give the answers that help our customers navigate the bankruptcy car loan process. Our goal is always to educate our customers so they feel confident they are making an informed decision.

Getting a Great Car. We work with a wide selection of late model used cars with low miles to choose from.

Many people view filing for bankruptcy as some kind of ending, but you’ll be much better off if you view it like a new beginning. Bankruptcy laws were designed to give you a fresh start. You owe it to yourself to make the most of this fresh start. And one way to do that is to start rebuilding your credit. Instead of thinking of bankruptcy as something that’s holding you back, think of it as the launching pad into a brighter financial future, because that’s exactly what it is. Now that you know about all 10 bankruptcy car loan benefits, what are you waiting for? The loan and car you need may be just a few clicks away. Get started today!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.