Close to a million non-business consumers seeking debt relief file for bankruptcy each year. Once you’ve decided that filing bankruptcy might be the only way for you to get your debt load back under control, the best way to make sure you choose the right type of bankruptcy and make a successful filing is to work with a qualified consumer bankruptcy lawyer. But how do you go about choosing a bankruptcy lawyer? This article will give you our opinion on how to make an informed decision. And if you’re asking yourself, “How do I find bankruptcy lawyers near me?” we’ll provide a great answer to that question at the end of this article.

A Solo Bankruptcy Lawyer, Small Firm or Bankruptcy Mill?

There are different approaches in the legal industry to bankruptcy cases. Some firms have figured out how to use non-lawyer paraprofessionals to handle the bulk of the work, including basic information intake, explaining the process, and making sure you gather all the required documentation about your debts and finances. With this “mill” approach that’s all about handling a high volume of cases, you might not even see a real lawyer until you have the meeting with creditors around a month into the whole process. People who end up going with a bankruptcy mill often feel like they were just another case and that their personal needs weren’t really considered. It’s also important to understand that there isn’t usually any financial advantage to going with a mill. Bankruptcy lawyer fees tend to fall within a fairly tight range in any given market. We recommend you go with a small firm or solo bankruptcy lawyer where you’re more likely to get the individual care and attention you deserve.

Focus on Your Local Geographic Area

The last thing you need is adding a long commute to your already-stressful situation. If you’re in the greater San Diego area of California, there are many qualified bankruptcy attorneys ready and willing to serve your needs. There is no need to travel long distances to find a great bankruptcy lawyer, so narrow your search down to those who are within an easy, comfortable distance from your home or work.

Bankruptcy Lawyer Reviews and Testimonials

As you visit the websites of various bankruptcy lawyers, avoid making the mistake of only relying on the customer testimonials provided on the site. Every attorney or firm wants to put their best foot forward on their own website, so you can assume that you’ll only find positive, glowing testimonials there. What you want to see are the customer reviews that are written and posted on sites like Google, Yelp and so on. You also get the advantage of seeing how many reviews have been posted and an overall rating based on all those reviews. This is a great way to further narrow your search.

The Costs of a Bankruptcy Lawyer

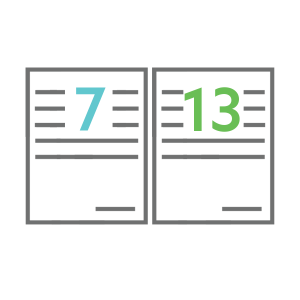

You want to be prepared for the costs of filing bankruptcy. The court-required fees to file in California are $335 for a Chapter 7 and $310 for a Chapter 13 (these fees do go up over time, last updated in California in 2016). Your bankruptcy lawyer fees are an additional cost you pay for the help provided in taking you through the whole process. Most bankruptcy attorneys will handle Chapter 7 bankruptcies for a flat fee that can range from $1,000 to $1,600 or more, depending on the complexity of your situation. In California the average is around $1,560 (the national average is $1,450). Attorney fees for a Chapter 13 are higher than a Chapter 7 because a Chapter 13 bankruptcy is more complicated due to its required repayment plan. When there is no business involved in a Chapter 13, the southern district of California that includes San Diego assumes fees in the range of $3,300 to $5,000 are normal and acceptable. If you’re in a low-income situation where you make less than 125% of the federal poverty level, you might qualify for free legal assistance to file bankruptcy. Options for this in San Diego County include the Legal Aid Society of California and the San Diego Volunteer Lawyer Program.

Success Rates for Chapter 13 Filers

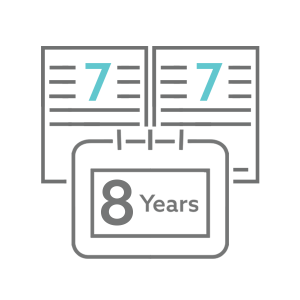

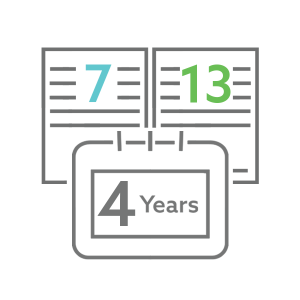

If a bankruptcy lawyer suggests that a Chapter 13 sounds like a good option for you, ask about their success rate on Chapter 13 filings. Nationwide, a lot of Chapter 13 cases fail. In fact, on average only 33% are successful. In part this is because people who try to file Chapter 13 without the help of a bankruptcy lawyer almost always fail, so working with a good attorney will increase your likelihood of success to more than 50%. But also keep in mind that these low success rates aren’t necessarily the fault of the bankruptcy lawyer. A Chapter 13 bankruptcy lasts 3-5 years – plenty of time for life to throw you a curve ball that throws you off your intended repayment plan. When that happens, your case may be dismissed or converted into a Chapter 7 case. But what you can say is this – bankruptcy lawyers with Chapter 13 success rates higher than the national averages are doing something right!

Personality, Customer Service, and Language Skills

You want to be comfortable with the bankruptcy lawyer you choose, so pay attention to their personality and customer service skills as you interact with them. You want someone who clearly cares enough to learn the particulars of your situation, your needs and wants to get you the best outcome possible. Also, if English is not your first language, then you’ll want to look for bankruptcy attorneys and firms that offer bilingual services so you can communicate in the language that works best for you. In the San Diego, there are plenty of options available to find Spanish-speaking bankruptcy legal assistance.

Bankruptcy Attorneys Recommended by Day One

One quick way to come up with a short-list of experienced bankruptcy lawyers in your area is to visit our recommended bankruptcy attorneys page. We’ve been helping bankruptcy filers find the used car loans they need for years. This has allowed us to get to know a number of bankruptcy attorneys, and we are proud to recommend any one of them to you. Your search for an experienced bankruptcy lawyer just got a whole lot easier! And if you find you need to replace your car after filing bankruptcy, we work with a network of excellent lenders who will compete for your business.

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.