Looking at all the different debts you owe versus what you make in terms of income can be an eye-opening experience. Some people go through life not paying attention to the big picture of their debt and income until something happens that forces them to do it. When the reality of the picture sinks in, it can cause a wave of panic, often followed by despair at what might feel like a hopeless situation. This is when filing for bankruptcy might be your best option to reduce your debts and work towards a brighter financial future. This article describes 10 different signs to help you realize when it may be time to file bankruptcy.

1. Struggling to Pay the Basics

If you find yourself having to choose which basic bills you can afford to pay each month and which ones to put off until next time, you’re either not earning enough income to meet your basic needs or have to send off too much of your income to keep up with your debts, leaving less for the basics. This can be the result of losing a job or experiencing a sudden medical emergency not fully covered by your health insurance (if you have health insurance to begin with). If debt payments are getting in the way of meeting your basic needs and normal bills, it may well be time to file bankruptcy.

2. Minimum Payments (or less) on Credit Cards

Missing the occasional payment here and there on a credit card is not a big deal. But if you find yourself in a situation with multiple credit cards and high balances where all you can ever do is pay the “minimum due” amount (and sometimes not even that much), you should definitely look at the rest your finances and see if it all is trying to tell you it may be time to file bankruptcy. Another variation on this problem is when you take a cash advance out on one card to make the payment on another, or if you’re constantly transferring balances to new cards. These are just delaying tactics that won’t solve your credit card debt problems in the longer term. In fact, it typically worsens the problem by allowing the debt to grow over time.

3. Collection Agencies are Constantly Calling

If you’re late on a loan payment, the company holding the loan will probably do an auto-call to remind you to make a payment. If the debt has been turned over to a collection agency because you’ve missed several payments, you can expect the calls to ratchet up in terms of frequency. Ignoring the calls is not a long-term strategy to free you from the mounting pressures of the debts you owe, which means it might be time to file bankruptcy.

4. Using Credit Cards or Personal Loans to Pay for Necessities

Some people purposefully use credit cards to pay for necessities because they earn rewards for their spending, such as frequent flyer miles and so on. That’s fine if they’re paying off their balance from month to month. But if you’re using credit cards to pay the basics because you don’t have enough money coming in, you run the risk of running up more credit card debt than you’ll be able to handle. This can be a reason to look at whether or not it’s time to file bankruptcy.

5. Debt Consolidation Looks Good

You’ve seen the offers to consolidate your debt with a company that also promises to lower your overall monthly debt payment. This sounds great from a cash-flow perspective because you’ll have more money each month to spend. It is rarely, however, a good idea in the bigger picture of your financial future. The consolidation gives you a lower monthly debt payment by spreading the payments out over a much longer period of time, which also masks the interest you’ll pay over those years. This can mean you’ll end up paying significantly more than your original debts in the long term. You might be better off exploring whether it’s time to file bankruptcy.

6. Lawsuits from One or More Debt Collectors

If you receive a court summons because you’ve ignored the attempts of debt collectors to get you to pay up, it’s important to understand that you could end up being responsible for all the court costs and other legal fees involved in the lawsuit. Filing bankruptcy will stop the lawsuit in its tracks and help protect you from other actions of debt collectors.

7. Wage Garnishing

After a lawsuit has been decided in favor of the debt collector, they have legal recourse to do things to get their money, although this varies by state. In some cases they can freeze your bank account. In other cases they can garnish your wages, which means your employer will be required to hold back a certain amount of your paycheck until the debt is paid off. Proactively filing for bankruptcy can prevent these sorts of things from happening. And make no mistake, wage garnishment is not as uncommon as you might think. Some estimates say as many as one in ten Americans have their wages garnished to pay off debts.

8. Foreclosure on Your Home

If you’ve fallen behind on your mortgage payments and foreclosure is looming on the horizon, bankruptcy can be a way to figure it all out and keep your home, either by eliminating many of your debts in a Chapter 7 bankruptcy, or sticking to a reasonable repayment plan over 3-5 years in a Chapter 13 bankruptcy.

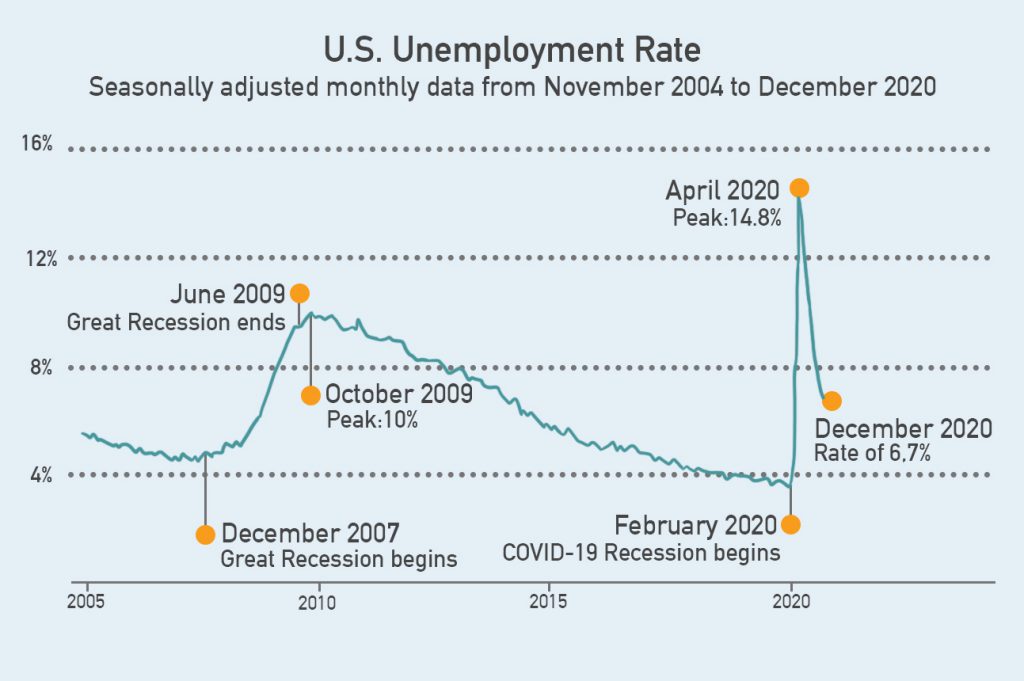

9. You’re Tired of Living Paycheck-to-Paycheck

If every month is a major struggle because of your debt, it’s worth taking time to figure out what’s really going on. If the debts you owe total up to more than half your annual income, it’s unlikely you’ll be able to get your debt under control in the foreseeable future. Missing multiple payments can result in vehicle repossession, student loan default, collection agencies and lawsuits, all of which will keep your credit score going down instead of up. Filing bankruptcy can help you turn that situation around (note that student loan debt is almost never covered by bankruptcy, so you’ll still have to make good on that).

10. Your Income Isn’t Going to Go Up and You’ve Spent Your Savings

Sometimes people who are struggling to keep up with their debts think they can hold out for more income, whether it’s getting a better-paying job or taking on an additional job (or two). But you need to be realistic about this. If the reality is that your income is not going to be going up any time soon, or only by a little bit, then your overall situation isn’t really going to change, which might mean a better approach is seeing it’s time to file bankruptcy. If you look ahead and come up with a real plan to pay off your debts but it’s going to take longer than five years to do it, bankruptcy might be a better option. What often goes along with this is running through all your savings to maintain debt payments and living expenses. If all the savings are gone and you still have more debt than you can manage, it may be time to file bankruptcy. If you haven’t already started spending your savings, then don’t! Protect your long-term financial health and that of your family by exploring bankruptcy as an option.

When one or more of the signs listed above apply to you, then it may be time to file bankruptcy. You’ll need the help of a qualified bankruptcy attorney to ensure it’s the right option for you and to make it happen. Day One Credit is pleased to recommend any of the lawyers listed on our Bankruptcy Attorney Page. Alternatively, also check out our post on how to choose a good bankruptcy lawyer.

If you are considering filing bankruptcy or have recently filed and realize you need to replace your car, Day One Credit specializes in finding bankruptcy car loans to help you get the vehicle you need without your bankruptcy getting in the way. Our goal is simple: Helping each customer going through bankruptcy find the car and loan they need while also helping them rebuild their credit. Feel free to contact us to speak with one of our friendly customer service representatives to learn more about how we can help. You can also get started right away when you apply online with our easy online application, which will give you an answer in a matter of minutes thanks to our network of lenders who all compete for your business. This is how we find the loan option that fits your situation!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.