When you’re in the process of deciding whether or not to file bankruptcy in order to get some debt relief, or if you’ve recently filed, you might start tuning into things you never noticed before. One example could be the phrase fresh start program. In this article you’ll find out what a fresh start programs are and how they can help you make the most of the new beginning filing bankruptcy gives you.

Your Post-Bankruptcy Mission: Rebuilding Your Credit

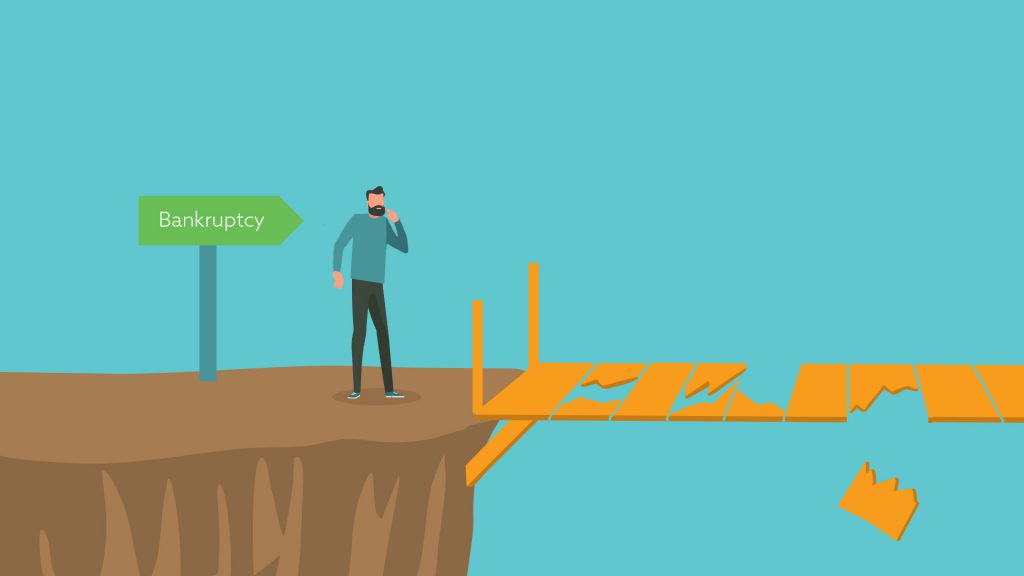

Filing for bankruptcy can sometimes feel like an ending – the last resort when you’ve accumulated so much debt that you feel like there’s no way out. After all, many people view bankruptcy as some kind of failure, so there can be a lot of stigma around it. But many people are suffering from crushing debts due to circumstances largely beyond their control, such as the unexpected loss of employment, a medical emergency or other life change that threw their financial lives into disarray. Whatever the reasons may be that have brought you to the place where you need to file bankruptcy, it’s much better to think of it not as an ending but as a new beginning. It’s a second chance to get your finances under better control. Thinking of it as a new beginning will motivate you to do the single most important thing you must do after filing, which is to rebuild your credit.

After the stress of filing for bankruptcy, too many people don’t do anything at all. They just wait for the process to be over, but when they do that, they’re missing out on time that could have been spent rebuilding their credit. The day you file for bankruptcy should be the day you start figuring out how to restore your credit. One way to that is through a fresh start program. This is not to be confused with the IRS “Fresh Start” initiative that is specifically geared towards helping people who owe a lot of back taxes to the government protect their property and resolve their tax issues.

A Bankruptcy Fresh Start Program Can Work Wonders

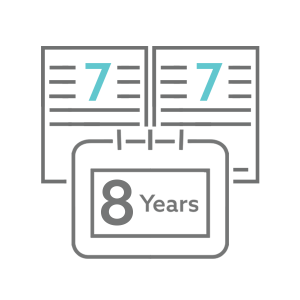

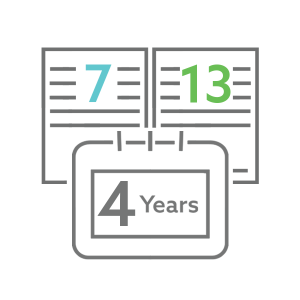

Many people think that bankruptcy does so much damage to their credit that there’s nothing they can do to fix it except wait the seven or eight years it takes for it to drop off their credit report. Not true! No one can put their financial life on hold for that long, and there are lenders out there who understand this and have developed specialized lending programs designed specifically for bankruptcy filers. These are the fresh start programs that help you rebuild your credit, even if they don’t specifically call them fresh start programs.

One way to restore your credit after a bankruptcy is to first and foremost keep up-to-date on your monthly payments for any debts that weren’t included in the bankruptcy, such as your mortgage or car payment. But another thing you can do is get a new loan and make on-time payments each and every month. Here’s where most people fail to take action. They assume there’s no way they can get any new credit with a recent bankruptcy filing. Again, not necessarily true! The whole point of a fresh start program is to do exactly that – extend you some credit in spite of your bankruptcy filing. While many lenders are unwilling to do this, but lenders with fresh start programs are ready to help.

The most important thing to keep in mind with any bankruptcy-related fresh start program is that in order to reap the credit-rebuilding benefits, you have to make your monthly payments on-time every time, so make sure you don’t take on a loan with payments you can’t afford.

How Does a Fresh Start Program Work?

Fresh start lenders are willing to take an extra risk by making loans to bankruptcy filers other lenders wouldn’t consider, but that also means that the interest rate you pay on the loan is going to be higher than normal. Think of those higher rates as a small price to pay for the chance to rebuild your credit so your future will be brighter!

While a fresh start program is geared towards helping bankruptcy filers get new credit, there are still going to be some eligibility guidelines you’ll have to meet. For example, at Day One our lenders want to see a maximum PTI (payment-to-income ratio) of 17% and a maximum DTI (debt-to-income ratio) of 50%. What do those numbers mean? Your PTI is how much of your gross monthly income would be taken up by your monthly car and insurance payment. Your DTI is how much of your monthly gross income goes toward all your various debts. We do not, however, have a minimum credit score requirement. In fact, you could have a score of 0 and might still qualify for a loan Day One finds you.

The most common types of fresh start programs are those that help bankruptcy filers get a mortgage, a car loan or a secured credit card. With a secured credit card, you make a cash deposit to cover the credit limit of the card so the card issuer is not at risk of losing out if you fail to pay the bill. After proving yourself with secured credit card over a period of time, you will eventually be able to get an unsecured card that doesn’t require a deposit. In the case of a mortgage or car loan, there will be more eligibility requirements since those are bigger loans.

Day One’s Fresh Start Program is for finding a Bankruptcy Car Loan

Day One Credit is a bankruptcy fresh start program that helps people find the car loan (and car) they need even though they have a recently-filed or discharged bankruptcy. Many people panic when they file for bankruptcy and soon afterwards realize they need to replace their car. How can they get a car loan when they just filed for bankruptcy? The fresh start program at Day One was designed specifically for this kind of situation. We help each eligible customer find the bankruptcy car loan that will best meet their specific needs.

At Day One we take great pride in sitting down with each customer to make sure we understand their needs as well as ensure eligibility for the lending programs in our network of lenders. Our prequalification eligibility guidelines include the following:

Income. Your minimum gross monthly income has to be $2,200 per month or higher as shown on either W-2 forms from your employer or 1099 forms if you’re self-employed.

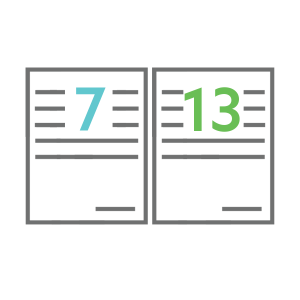

Bankruptcy Status. Your bankruptcy must be filed or recently discharged. We can work with you as soon as you get your Chapter 7 case number or your Chapter 13 confirmed repayment plan. We have programs for both open and recently discharged bankruptcies.

Valid Driver’s License. You must hold a valid driver’s license that is not suspended.

Even if you meet those guidelines, there are instances where we don’t recommend going for a bankruptcy car loan, including the following:

You already have a great car. If your current vehicle is newer, has relatively low mileage, is paid off or close to being paid off, then it makes sense to stick with it.

No stable income. If your income is not stable or you know your income is about to drop or your expenses are about to go up (or both).

The cosigner on your car did not file for bankruptcy. You can damage your cosigner’s credit if they did not file bankruptcy with you. You have the right to surrender your car, but your cosigner does not have the same right, and the lender will still go after your cosigner.

The benefits of working with Day One to find a bankruptcy car loan are important to describe. One big benefit is that we have no-money-down options available to most customers. Another benefit is our extensive experience. We’ve been working exclusively with bankruptcy filers for years and know how to make this work for you. Our customers get great results and enjoy being treated like VIPs. We’ve developed a network of experienced lenders who have programs designed specifically for bankruptcy customers, and when they compete for your business, you get a better deal. You’ll also enjoy finding the car you need in our inventory of high-quality vehicles – newer model years in great condition with low miles that will serve you well for years to come.

If you’re ready to make the most of your bankruptcy fresh start, apply now by filling out our short application online and get an initial answer within minutes!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.