If you’re in the process of deciding you need to file a Chapter 7 bankruptcy in order to get relief from large amounts of debt, what should you do if you also realize you need to get a different car? Maybe your current situation has made you realize the car you’re driving now is more expensive than you can afford. Or maybe your current vehicle needs too many expensive repairs or just died altogether. Whatever the reason may be, the combination of needing a car and needing to file bankruptcy can feel overwhelming. But don’t worry, you may be able to get a Chapter 7 bankruptcy car loan to get the vehicle you need even while getting a fresh start through bankruptcy. Here’s how to do it in just 7 steps:

Step 1: File for Bankruptcy BEFORE Applying for a Bankruptcy Car Loan

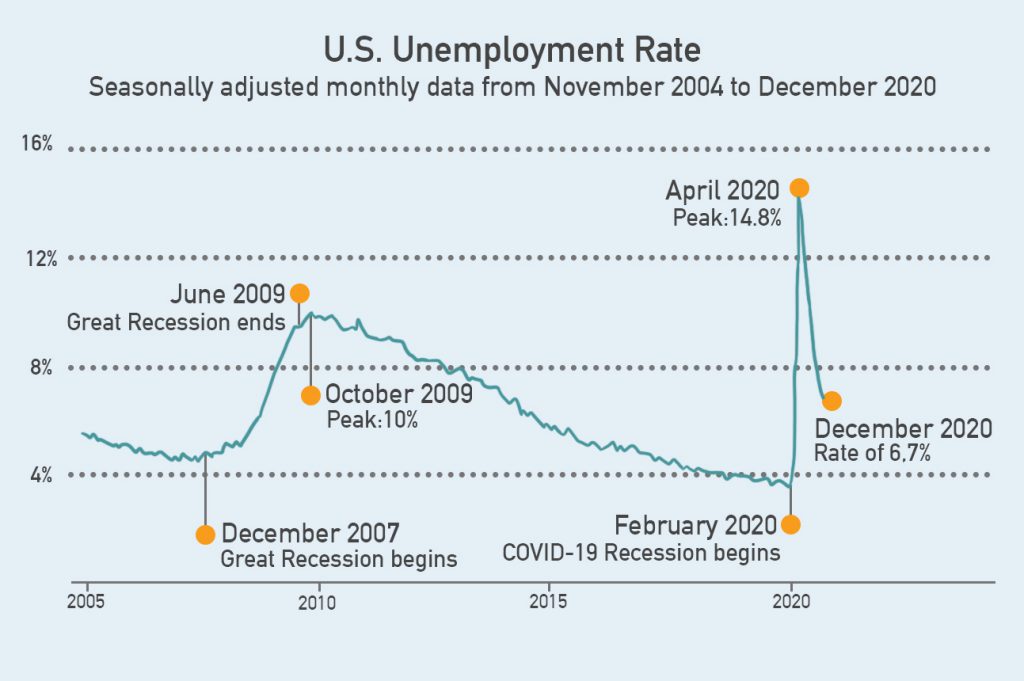

One of the biggest myths out there is that filing for bankruptcy does so much damage to your credit score that if you need to finance a car purchase, you should hurry up and apply for that before you file for bankruptcy. Not necessarily!

If your financial situation and debt load has gotten to the point where you need file for bankruptcy, your credit score is probably already very low. In fact, it may be so low that you you’ll be rejected by many lenders. But there are lenders out there who specialize in helping people finance a vehicle purchase once you have filed for bankruptcy, but not before. Before you file bankruptcy, you’re just another person with bad credit. But after you file bankruptcy, then you become a consumer who is taking action to improve your debt situation. With a Chapter 7, a big chunk of your debts are going to just be wiped away entirely. Bankruptcy lenders are the ones willing to recognize that your situation is getting better, and are willing to help you finance the vehicle purchase you need to make.

When you’re on the verge of filing bankruptcy and need a car, getting a bankruptcy car loan may be your best option, but you do have to file for bankruptcy first in order to be eligible for one!

Step 2: Assess Your Car Needs Prior to Seeking an Open Chapter 7 Auto Loan

Before you apply for a Chapter 7 bankruptcy car loan, it’s important to spend some time thinking through your current car situation and what your vehicle needs are, as well as whether or not you meet the eligibility requirements for whatever bankruptcy lender you end up working with. If you choose Day One Credit, below are the eligibility requirements to keep in mind. Most bankruptcy lending services will have similar eligibility requirements, though these will vary by location and company.

Minimum monthly income: You need to show you’ve got at least a gross income of $2,200 in order to apply for a bankruptcy car loan. If your income is unstable or you know it’s going to be dropping (or your expenses are going to going up, or both), then you probably shouldn’t apply.

Valid license: Your driver’s license must be current and not under any kind of suspension.

You don’t already have the right car: This should be obvious, but if the car you’re currently driving is newer, has low miles, is in great shape, meets your needs, and you can afford to keep making on-time payments on your current loan, you should stick with it! At Day One Credit, our goal is to help get you into a high-quality used car you can afford that will meet your needs.

If your car is already dead, then you clearly need to get something to replace it. You might also notice that your current car is old enough that it seems to need constant repairs, which are starting to cost you more than you can afford. This is another case when it might make sense to go for the bankruptcy car loan. Maybe your family is growing and you need a bigger car. Or maybe you just got a new job that’s further away and you want to get a car with better fuel efficiency than the one you’re driving now. These are all legitimate reasons to try for a bankruptcy auto loan.

Step 3: Consult Your Bankruptcy Attorney

Most people need the help of a qualified bankruptcy attorney to do the filing. You should feel free to reach out to your bankruptcy attorney and get their advice if you have to replace your current vehicle. Your attorney may know of a reputable lender you can work with in your area.

If you’re looking for a bankruptcy attorney because you haven’t filed yet, visit the Day One Attorneys page for our recommendations on who you can work with.

Step 4: Find a Dealership/Lender that Works with Bankruptcy Customers

Not all dealerships who help with financing are willing to work with bankruptcy customers. Most dealerships simply don’t have experience working with bankruptcy customers, so they don’t have an understanding of their needs or how to deal with them. In addition, unless the dealership has specifically developed a network of lenders who work with bankruptcy customers, the lenders they do work with may not want to lend to bankruptcy customers.

With all the people filing bankruptcy these days, you might wonder why there aren’t more dealerships willing to work with bankruptcy filers. In part, it’s because of geographical limitations. In smaller cities or rural areas, there aren’t enough people filing bankruptcy for most dealerships to bother going through the work of learning how to serve bankruptcy customers or develop a network of bankruptcy lenders. In major metropolitan areas, however, it’s a different story. In big cities there is enough of a market for some companies to specialize in serving bankruptcy customers.

Step 5: Apply, Get Approved, and Go Car Shopping!

Once you find the dealership and lender combination that is ready, willing, and able to work with you as a bankruptcy customer, then you can apply, get approved and go car shopping! But it’s also very important for you to avoid making some of the most common and worst mistakes people make with their open Chapter 7 auto loan, which all revolve around buying the wrong car. Whatever you do, don’t buy one of the following:

An older car with high miles. When you settle for an older vehicle with high miles, you often end up paying a lot more in repairs that you expected. When you add all those repair costs to what you’re already paying for the car, you might have been better off paying a higher price on a newer vehicle with fewer miles that doesn’t need to be in the repair shop all the time.

An expensive luxury car. Filing for bankruptcy gives you the chance to make a fresh start, but it’s up to you to be responsible and buy a car you can afford if you want to rebuild your credit. If you go for an expensive luxury car, you may not get approved. And even if you manage to get approved, what will you do if your circumstances change and the car becomes too expensive for you to keep? Be realistic about your circumstances and what you can truly afford.

A brand-new vehicle. Buying a brand-new vehicle is often a bad idea because of the depreciation factor. In the first several years your new car loses 15-25% of its value each year, which means you’ll be “underwater” or “upside” down on the loan for years to come. When you buy a high-quality used vehicle, it’s the previous owner who already took the big hit on depreciation, which means you’re getting a great car for a lot less money!

A salvage car. Salvage cars are cheap, but almost always come with a host of problems that will start popping up and costing you tons of money in repairs.

A car you can’t afford. The last thing you want to do with your fresh start from bankruptcy is buy more car than you can really afford. If you experience any kind of hiccup with your income, you could end up in trouble. You should avoid even going for anything that results in a monthly payment that would be a stretch for you to make. Set yourself up for success by shopping for vehicles that are well within what you can afford.

A lemon. Cars with prices that seem too good to be true are probably just that! There could be hidden frame damage, flood damage or all kinds of other safety issues that will end up costing you way more than you bargained for.

At Day One Credit, we serve as the go-between to meet all your needs, both in terms of finding you the best Chapter 7 bankruptcy car loan from our network of lenders as well as helping you find the right car for your bankruptcy situation.

Step 6: Surrender Your Current Car (if you have one)

If you have positive equity in your current car, any dealership you work with on purchasing your next car should be willing to take your current vehicle off your hands, even if it’s no longer running, and also offer you a fair price for it as a trade-in. It’s probably wise to get the dealership to value your trade-in before you even say you’re shopping for another vehicle. This forces them to make you as fair an offer as they’re going to make rather than low-ball an offer and divert your attention away from that by focusing on the car you’re going to buy from them.

If you have negative equity in your current car and/or do not want to trade it in, you can surrender your vehicle to your lender. Ask the dealership you are working with if they can help you with the process as it may take time for the lender to pick up the vehicle.

7. Enjoy Your Ride and Make All Your Payments On Time

Your last step is to enjoy your ride! But not just that. You recently filed for bankruptcy, so you know the painful reality of struggling financially. Now you’re getting a fresh start through bankruptcy, which means you can immediately start to rebuild your credit and boost your credit score by making all your car payments on time, every month.

Ready to find out how Day One Credit can help you find the car you need and a Chapter 7 Bankruptcy Car loan? Get in touch or jump right in and apply now!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.