A question that comes up frequently has to do with the timing of buying a car when there is a bankruptcy involved. Should you buy your next car when your bankruptcy is still open, or should you wait until you receive your bankruptcy discharge? Most people tend to think the answer to this question surely must be that it’s better to wait until you receive your discharge. After all, when you receive your discharge, then the bankruptcy is over and it must be better to buy a car when the bankruptcy is over, right? This article provides guidance on how to answer this question because it’s not as simple as you might think!

You Can Wait for a Discharge, but Why?

If your car dies while you have an open bankruptcy, the answer to the question is clear. You can’t wait for your bankruptcy discharge because you need a car now, unless you can manage to get by on public transportation or asking friends and family for rides everywhere you need to go. That’s not going to work for most people, so waiting for a discharge won’t even be an option in those cases.

Another basic assumption here is that you’ll need to finance your purchase. Most people with an open bankruptcy obviously don’t have thousands of dollars lying around to buy a car. This is what makes buying a car during a bankruptcy tricky. Many lenders won’t give you the time of day with an open bankruptcy, which is why you might need help finding a bankruptcy car loan.

But what if you could wait to buy your next car. Should you? Is there any advantage to waiting for your discharge? Now the answer becomes maybe. The only advantage to waiting is if you can realistically save up money for a bigger down payment as you wait for your discharge to happen. But that’s the only reason. Otherwise, there is literally no reason to wait.

The Reason Waiting for a Discharge Doesn’t Help

At this point, you might be scratching your head, wondering why waiting for a discharge doesn’t help. You think if the bankruptcy is over, more lenders will be willing to give you a car loan, right? Wrong, unfortunately. It’s a scenario many people find out the hard way, and it goes like this. You’ve patiently waited to finally receive your bankruptcy discharge because you want to buy your next car. You find the vehicle you’re interested in and go to your bank or credit union to find out what kind of loan you can get. But the lender rejects you because of your bankruptcy. They say you won’t be considered for a car loan until two years have passed after you received your discharge. Needless to say, this is very disappointing and frustrating for the people who have been waiting for their bankruptcy discharge thinking it would help them get a car loan.

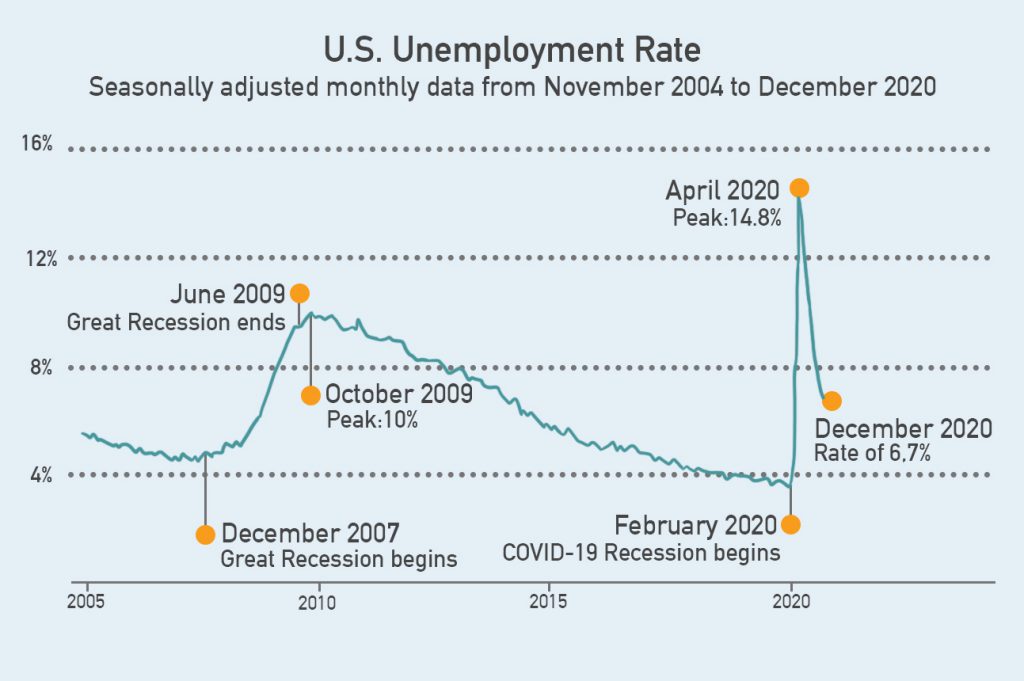

So why doesn’t getting your bankruptcy discharge make a difference? Why do so many lenders want to wait two more years after your discharge before they’ll even consider making a loan to you? There’s no good reason other than it’s the tradition that developed as a way to mitigate risk in their loan operations. Lenders view the bankruptcy customer as a much riskier proposition than lenders with good credit and without a bankruptcy. Most lenders are very “risk adverse.” They want to lend money knowing they’re going to get it back, and then some in the form of interest. The look at a consumer’s past history (credit report) to determine how risky a loan to that person will be. Bankruptcy is seen by them as a such a big red flag that they want to see how you handle paying your bills for at least two years after a bankruptcy discharge to make sure you’ll be able to handle making loan payments.

Buying Before Your Discharge Might Actually Help

At Day One Credit, we tap into a strong network of lenders who have special lending programs designed specifically for bankruptcy customers, including those with an open bankruptcy and those with a recent discharge. You will pay higher interest rates for a bankruptcy car loan because of the higher risk the lender is taking on, but Day One will help you find the loan that fits your situation. It has also been our experience that in some cases, the best rates we can find on bankruptcy car loans are for people whose bankruptcy is still open and not yet discharged.

This is why, in our opinion, waiting for a discharge doesn’t help except for coming up with a larger down payment, which is always a good thing to do if you can. Lenders like larger down payments, and you end up paying less interest the less you finance, so it’s a win-win on that front. If you’d like to make the most of your fresh start, check out our article Your Life After Bankruptcy: 7 Tips for Moving Forward. But we can also find bankruptcy car loans for most customers that don’t require any down payment at all.

Finding a Bankruptcy Car Loan through Day One Credit

At Day One Credit, we make it as easy as possible to help you find a bankruptcy car loan when you need one, whether it’s whether your bankruptcy is open or recently discharged. Here’s how it works:

Get Educated: Check first with your bankruptcy attorney in order to determine whether or not a bankruptcy car loan is a good idea. If it is, we’ll be happy to help!

Apply: All you have to do is fill out our quick online application, which will take you less than five minutes. We’ll review your information and contact you if we need to clarify anything. Then we send your application out to our full network lenders. When their offers come in, we select the one with the best terms to present to you.

Find Your Ride: Once you find your bankruptcy car loan, then you’re free to check out our selection of late-model used cars with low miles and in great condition to find your next ride!

Day One Credit works exclusively with bankruptcy customers, and our team has years of experience helping people find financing for a car purchase in spite of an open or recently discharged bankruptcy. Got questions? We’re always happy to help you understand your options. Check out our Common Questions page, or give us a call at 855-475-4725!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.