If you find yourself needing a car when you’re in the middle of a bankruptcy, or even when you’ve had one recently discharged, finding a way to finance the purchase of a used car can become a major challenge. Many lenders won’t give you the time of day when they see the dreaded “B” word on your credit report. This can often mean you’ll need to seek alternative lenders to meet your financing needs, such as lenders who specifically work with bankruptcy car loans. But before you dip your toe into those waters, you should think about bankruptcy car loan expectations. While chances are fairly good you’ll be able to find what you need (especially if you work with the right experts), you’ll also want to have realistic bankruptcy car loan expectations.

Expectations About Lenders Working with Bankruptcy Customers

Lenders are in the business of making loans to people because they can make money doing it, but only if the loan recipient pays it all back and then some in interest charges. Each lender has to figure out how they’re going to assess the level of risk when making loans, which means they try to figure out who is most likely to make good on their loan commitment and making the monthly payments on it. Your credit score and credit history are the main tools available to lenders for making these kinds of decisions. Your credit report contains the facts of how responsible you’ve been with credit in the past and what kind of debt load you carry. If the lender sees too many “red flags,” then they will consider you too risky and deny your loan application.

Although your credit report reveals many aspects of your past behavior related to credit and debt, every lender is going to have their own standards about what they find to be an acceptable or unacceptable level of risk in potentially making a loan to you. Many lenders have decided that a credit score under a certain level or seeing a bankruptcy in your credit history are enough to disqualify you. These lenders are what you might call “risk-averse” because they want to ensure they’re going to get their money back with interest. To them, a bankruptcy means you’re more likely to default on a loan.

The Interest Rate Factor in Bankruptcy Car Loan Expectations

When you’re looking to get a loan of any kind, one of the most basic things you want to know about is the interest rate or annual percentage rate (APR). This is important because it tells you how much you’re going to pay over the life of the loan for borrowing the money you need to make a purchase. Part of having realistic bankruptcy car loan expectations is understanding and accepting the fact that you will have a higher interest rate on your car loan that someone with great credit and no bankruptcy red flags on their credit history. But why is this the case?

As stated above, many lenders find bankruptcy customers too risky to work with. But there are lenders out there who are willing to make loans to bankruptcy customers. These are the lenders who understand that bankruptcy is a way to get yourself back on track financially, so they think of bankruptcy in a more positive way than risk-averse lenders. And yet they also recognize there really is more risk when lending to bankruptcy customers. In order to compensate for the increased risk they’re taking on by making a loan to you, they charge a higher interest rate. How much more is going to vary widely from lender to lender.

At Day One Credit we help find you a bankruptcy car loan by tapping into our strong network of multiple specialized lenders who are willing to work with bankruptcy customers. The median interest rate for such loans is around 18%. Is that significantly higher than used car loans for customers with great credit? Yes, it is, and it representative of the risk that lenders factor in when financing customers with open or recently discharged bankruptcies.

Expectations About the Car You Will Buy

Another area where you will be better off with realistic bankruptcy car loan expectations is what kind of car you will buy. If you’re in the middle of a bankruptcy or recently had one discharged, you probably don’t have a ton of money lying around to put towards the purchase of a car. If somehow you do, then go for whatever you want. But if money is tight, you have to be smart about the kind of car you buy.

In our opinion and experience working with bankruptcy customers, you should keep yourself from dreaming about buying some kind of high-end luxury car. You probably can’t afford one. Besides the high price of the vehicle itself, everything else related to the car will also be more expensive. The insurance will be more expensive. Repairs and maintenance will be more expensive. Even the fuel you put in the gas tank could be more expensive if the vehicle requires premium-grade gasoline. If you’re trying to get back on track financially after bankruptcy, overcommitting yourself by trying to purchase a luxury car you can’t afford simply isn’t going to help you. And if money is tight and your credit has taken a major hit from bankruptcy, you probably won’t get approved for a loan large enough to even attempt purchasing a luxury car.

In fact, it is our opinion at Day One that you shouldn’t even try to buy a brand-new car. They’re more expensive just by being the most recent model, and then you take a really big hit on depreciation as soon as you drive a new car off the lot. The car’s value will drop by 15%–20% in the first year and for several more years, which means you’ll probably be “underwater” on the car for years, meaning you owe more on the car loan than the car is worth. This is not the position you want to be in with a bankruptcy on your credit report.

But we also don’t recommend buying an old used clunker. Those kinds of cars can also end up costing you more than they’re worth because of the constant stream of expensive repairs they often require to keep them running. What we do recommend is a late-model (less than five years old) used car in great condition with lower mileage. This is the kind of car that gives you the most bang for your buck. It will serve you well for good long time and won’t likely need a lot of repairs in the near future. Please read more about best car choices for bankruptcy car loans.

Here at Day One Credit, we take the time to understand what you need in a vehicle and what resources you have available for making a purchase. Our goal is to find you an excellent used car that you can really afford, and find you the right bankruptcy loan from our network of lenders so you can buy it. We call that a win-win scenario!

The Credit Repair Aspect of Bankruptcy Car Loan Expectations

Part of why a bankruptcy car loan may be a good idea for you is the role it can play in repairing and restoring your credit during and after bankruptcy. But once again, it’s best to have realistic expectations about this.

When you’re in the midst of a bankruptcy, as well as after having one discharged, your credit score is probably quite low—possibly the lowest it’s ever been depending on how it declined in the period of time leading up to your bankruptcy filing. Here’s the catch-22 of fixing your credit: You have to prove to the credit bureaus you can handle credit responsibly at a time when you likely have a lot less credit available to you, or none at all. You need to get some new credit to show you can use it responsibly, but this can be a major challenge given how many lenders simply won’t work with bankruptcy customers as previously described. This is when a bankruptcy car loan from the right lender can help put you on the path of showing a whole new you with new credit and responsible behaviors.

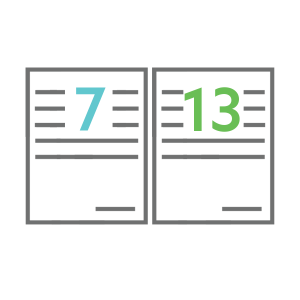

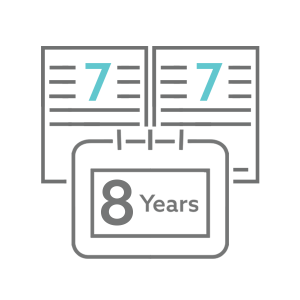

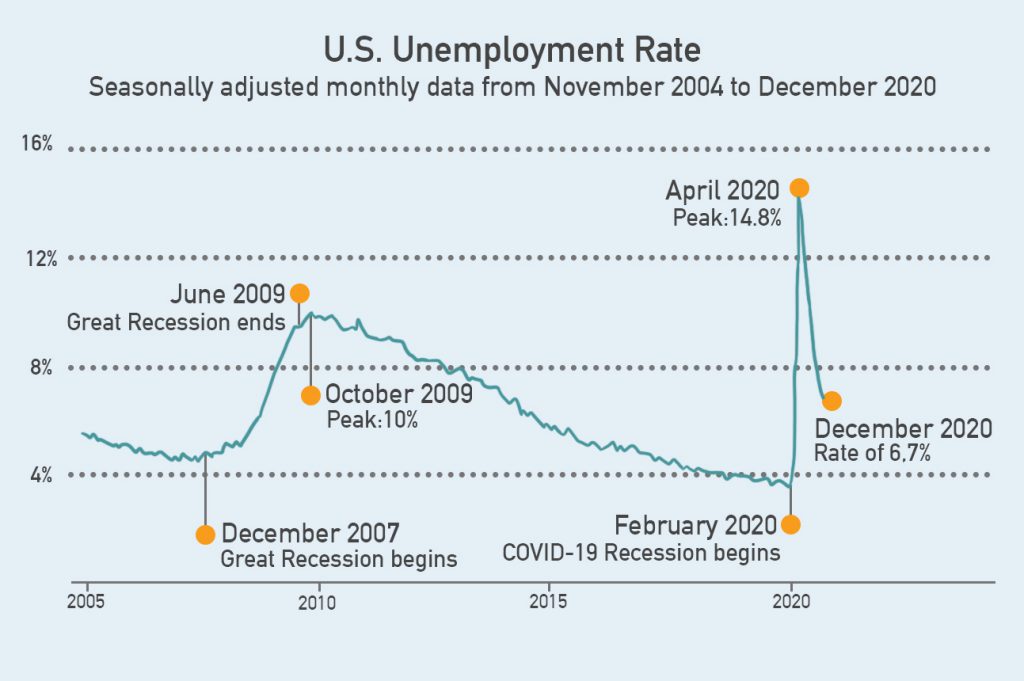

But it’s not a magic pill that will automatically make everything better. The bankruptcy “red flag” is going to remain on your credit report at least seven years. The bankruptcy car loan can help your credit score move in an upward direction, but only if you are very careful to make every monthly payment on time. This is part of why we emphasize making sure you buy a car you can really afford. Late or missed payments will only further reduce the credit score you’re trying to raise! Making those on-time payments every month is the key to seeing your score begin to move in the right direction.

The Day One Credit Approach to Bankruptcy Car Loan Expectations

Our approach to bankruptcy car loan expectations at Day One is simple: We want to help you get the car you need with a loan that’s going to work as well as possible for you. But we can’t work with everyone. Listed below are the eligibility requirements we need to see before we can try to help you find a bankruptcy car loan:

Income: We want to see a minimum gross monthly of income of $2,200 per month as shown on either your employer’s W-2 forms or 1099 forms if you’re self-employed.

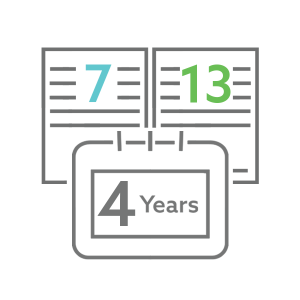

Bankruptcy Status: To be eligible for a bankruptcy car loan, you must have already filed your bankruptcy or had it recently discharged. We just need to see your case number (Chapter 7), approved payment plan (Chapter 13), or your discharge.

Valid Driver’s License: Your driver’s license must be up-to-date and not suspended or you won’t be able to register a vehicle at all to begin with.

And we’ve also made the whole process as fast and as convenient as possible for you, including the following features and benefits:

Little or no money down: It’s always better for you if you can make as much of a down payment as possible, but if you can’t, that’s okay too. Day One can find most customers bankruptcy car loans that don’t require any down payment at all.

No need to wait: You don’t have to wait until your bankruptcy is finalized or discharged. You can apply as soon as you have your initial bankruptcy papers or a case number. Note, however, that in a Chapter 13 you will also need written approval from your trustee to take on a new loan.

Great cars available: The same vehicles available to everyone else are also available to you. We strongly recommend a late-model used car in great condition with low mileage that you can afford without stretching your budget.

VIP treatment: Unlike the lenders who look down their noses at you when they see a bankruptcy on your credit report, we give you the VIP treatment we think everyone deserves, regardless of their credit history. We’ll give you our full attention and show you the same courtesy and respect we would show anyone.

Ready to learn more? Check out our common questions page, get in touch through the contact us page of our website, or give us a call directly at 855-475-4725. You can also go ahead and get started by applying online now!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.