When people need relief from crushing debts, there are two main types of bankruptcy available to them: Chapter 7 and Chapter 13. Many of the most common bankruptcy questions people ask are about how filing bankruptcy affects the car they already have, or what their options are when they have filed for bankruptcy and discover they need to replace their car. In this article, you’ll find answers to many of the common bankruptcy questions, and especially those that relate to buying a car during or after a bankruptcy.

One of the first questions people often ask is this: What is a fresh start program? You’ll see this phrase a lot when you’re exploring information about bankruptcy car loans. Bankruptcy laws were designed to help people reduce their debts make a “fresh start.” A Fresh Start Program means a loan program designed specifically to help people get the credit they need even though they have filed for bankruptcy. Among the most common fresh start programs are those to help bankruptcy filers get a car loan when they need to purchase a car in spite of an open or recently discharged bankruptcy.

Chapter 7: Common Bankruptcy Questions

A Chapter 7 bankruptcy, also called a “straight” bankruptcy or “liquidation” bankruptcy, is an option for people who definitely don’t have enough regular income to ever realistically pay back the debts they owe. Keep in mind that not all debts qualify for inclusion in a Chapter 7 bankruptcy. Student loans, back taxes, child support, and alimony are typically not included (although in rare cases they may be included).

You will be required to sell off or liquidate any available property or assets to pay back as much of your debts as possible. But you don’t have to sell “exempt” property such as your car or house since you still need a place to live and way to get around. After any non-exempt property and assets are sold, any remaining qualifying debts will be wiped away entirely, giving you a fresh start. Here are the common bankruptcy questions people ask about Chapter 7 and how it relates to their car and buying a car:

Does Chapter 7 cover car loans?

A Chapter 7 bankruptcy can include your current car loan if you want it to. If you include your current car loan in your Chapter 7 bankruptcy filing, then you will have to surrender the vehicle. The upside to doing this is that it allows you to walk away from a car and loan you can’t afford because any remaining debt will be eliminated. The downside, of course, is that you won’t have a car. However, you then have the option of seeking a more affordable vehicle through a bankruptcy car loan.

A Chapter 7 bankruptcy can include your current car loan if you want it to. If you include your current car loan in your Chapter 7 bankruptcy filing, then you will have to surrender the vehicle. The upside to doing this is that it allows you to walk away from a car and loan you can’t afford because any remaining debt will be eliminated. The downside, of course, is that you won’t have a car. However, you then have the option of seeking a more affordable vehicle through a bankruptcy car loan.

Does Chapter 7 stop repossession?

Yes! If you’re behind on your payments and are on the verge of having your car repossessed, filing a chapter 7 bankruptcy will stop the debt collection and repossession process through what’s called an “automatic stay.” But it’s only a temporary halt to repossession and debt collection. During your Chapter 7 bankruptcy process, the lender can ask the court to lift the automatic stay so they can repossess your car. One option for you is to work with your lender on a plan for how to keep the car. The lender may be willing to reduce your payments, your interest rate, or even your principal balance because they know the debt will be entirely discharged if it ends up being part of the bankruptcy. Another option is to come up with the money to get current on your car loan, which tends to not be an option for most people in bankruptcy. You can also go ahead and surrender the vehicle and walk away from the loan, but then you don’t have a car at all (although a bankruptcy car loan is an option).

Yes! If you’re behind on your payments and are on the verge of having your car repossessed, filing a chapter 7 bankruptcy will stop the debt collection and repossession process through what’s called an “automatic stay.” But it’s only a temporary halt to repossession and debt collection. During your Chapter 7 bankruptcy process, the lender can ask the court to lift the automatic stay so they can repossess your car. One option for you is to work with your lender on a plan for how to keep the car. The lender may be willing to reduce your payments, your interest rate, or even your principal balance because they know the debt will be entirely discharged if it ends up being part of the bankruptcy. Another option is to come up with the money to get current on your car loan, which tends to not be an option for most people in bankruptcy. You can also go ahead and surrender the vehicle and walk away from the loan, but then you don’t have a car at all (although a bankruptcy car loan is an option).

Can you keep a financed car in Chapter 7?

Yes! But you don’t have to. If part of the problem is that you really can’t afford the car you have, it’s worth considering including it in the bankruptcy, surrendering the car, eliminating any remaining debt you owe, and then getting a bankruptcy car loan for a vehicle that’s more affordable for you. There are lenders out there who see your bankruptcy filing as a positive step to getting your finances back on track. These lenders may be willing to give you a bankruptcy car loan.

Yes! But you don’t have to. If part of the problem is that you really can’t afford the car you have, it’s worth considering including it in the bankruptcy, surrendering the car, eliminating any remaining debt you owe, and then getting a bankruptcy car loan for a vehicle that’s more affordable for you. There are lenders out there who see your bankruptcy filing as a positive step to getting your finances back on track. These lenders may be willing to give you a bankruptcy car loan.

Can I buy a car after filing Chapter 7?

Yes! You can apply for a car loan at any time, regardless of your bankruptcy status. However, some lenders won’t work with you because of your bankruptcy status, which they see as a huge negative risk factor. But there are other lenders who see your bankruptcy through a more positive lens, so the moment you file for a Chapter 7 bankruptcy, you might be eligible for a bankruptcy car loan from a lender who is willing to work with bankruptcy customers.

Yes! You can apply for a car loan at any time, regardless of your bankruptcy status. However, some lenders won’t work with you because of your bankruptcy status, which they see as a huge negative risk factor. But there are other lenders who see your bankruptcy through a more positive lens, so the moment you file for a Chapter 7 bankruptcy, you might be eligible for a bankruptcy car loan from a lender who is willing to work with bankruptcy customers.

Can I buy a car before filing Chapter 7?

You can try to buy a car before filing a Chapter 7 bankruptcy, but you may not be successful. If you’re on the verge of filing bankruptcy, your credit score is probably already very low, which means most some lenders won’t take a chance on you. But since you haven’t actually filed for bankruptcy yet, the specialized lenders who work with bankruptcy customers also won’t work with you because they haven’t seen you take the positive step of filing for bankruptcy to make a fresh start.

You can try to buy a car before filing a Chapter 7 bankruptcy, but you may not be successful. If you’re on the verge of filing bankruptcy, your credit score is probably already very low, which means most some lenders won’t take a chance on you. But since you haven’t actually filed for bankruptcy yet, the specialized lenders who work with bankruptcy customers also won’t work with you because they haven’t seen you take the positive step of filing for bankruptcy to make a fresh start.

Can I buy a car after chapter 7 discharge?

Yes! But once again you have to make a distinction between lenders who do and do not specialize in helping bankruptcy customers. Some lenders will tell you to wait at least two years after your bankruptcy discharge before applying for a loan with them. They still see you as a very high-risk case when it comes to loans. But the lenders who work with bankruptcy customers see your discharge as your fresh start and may be willing to work with you.

Yes! But once again you have to make a distinction between lenders who do and do not specialize in helping bankruptcy customers. Some lenders will tell you to wait at least two years after your bankruptcy discharge before applying for a loan with them. They still see you as a very high-risk case when it comes to loans. But the lenders who work with bankruptcy customers see your discharge as your fresh start and may be willing to work with you.

How long do you have to wait to buy a car after Chapter 7?

You don’t have to wait at all. If you need to, you can apply for a bankruptcy car loan the day you file for bankruptcy. As soon as you have a Chapter 7 case number, you become eligible to work with the lenders who specifically serve bankruptcy customers. You can apply as soon as you file, at any point while your bankruptcy is open, or after your debts are discharged.

You don’t have to wait at all. If you need to, you can apply for a bankruptcy car loan the day you file for bankruptcy. As soon as you have a Chapter 7 case number, you become eligible to work with the lenders who specifically serve bankruptcy customers. You can apply as soon as you file, at any point while your bankruptcy is open, or after your debts are discharged.

What happens to your car when you file chapter 7?

When you file for a Chapter 7 bankruptcy, there are three basic things that can happen to your car. First, can just surrender it and walk away from the loan, as previously described. Second, you can “retain-and-pay” where you include the car loan in the bankruptcy so the lender can’t go after you or your car but you continue to make your payments and keep driving the car (not all lenders go for this arrangement, but many will). Third, you can sign a “reaffirmation” agreement where the loan is not included in the bankruptcy and you promise to make good on your payments moving forward, which means you’re still personally liable and can have your car repossessed if you fall behind in your payments.

When you file for a Chapter 7 bankruptcy, there are three basic things that can happen to your car. First, can just surrender it and walk away from the loan, as previously described. Second, you can “retain-and-pay” where you include the car loan in the bankruptcy so the lender can’t go after you or your car but you continue to make your payments and keep driving the car (not all lenders go for this arrangement, but many will). Third, you can sign a “reaffirmation” agreement where the loan is not included in the bankruptcy and you promise to make good on your payments moving forward, which means you’re still personally liable and can have your car repossessed if you fall behind in your payments.

Chapter 13: Common Bankruptcy Questions

In a Chapter 13 bankruptcy, the idea is that you have enough regular income that you can get caught up on your debts if you just had some extra time. Filing Chapter 13 will stop all the debt collection efforts by those you owe. Then you’ll work with a bankruptcy court trustee to come up with a reasonable payment plan to repay your debts or get caught up on your debt payments over the course of 3-5 years. A Chapter 13 bankruptcy is also called an “adjustment of debts” or “reorganization” bankruptcy because in working out the payment plan with those you owe, many of the qualifying debts will be adjusted in some way, such as reducing the interest rate, the principal, or the payment amount. Giving you this kind of break on your debts, along with extra time, is what allows you to get caught up and back on track with a court-approved payment plan.

Can I surrender my car in Chapter 13?

Yes! But you don’t have to. In a Chapter 13 bankruptcy, you’ll have a repayment plan that lasts 3-5 years, during which time debt collection efforts are stopped and you have the chance to get caught up on your debt payments. If at any time during the years of your open Chapter 13 bankruptcy case something changes and you need to get rid of the car, you can surrender it and then at the end of the bankruptcy any remaining debt owed will be discharged.

Yes! But you don’t have to. In a Chapter 13 bankruptcy, you’ll have a repayment plan that lasts 3-5 years, during which time debt collection efforts are stopped and you have the chance to get caught up on your debt payments. If at any time during the years of your open Chapter 13 bankruptcy case something changes and you need to get rid of the car, you can surrender it and then at the end of the bankruptcy any remaining debt owed will be discharged.

Can my car be repossessed during Chapter 13?

No! When you file a Chapter 13 bankruptcy, an “automatic stay” will be issued by the bankruptcy court that stops most if not all debt collection efforts on qualifying debts, including repossession of your car. There is some lag time between when you file for Chapter 13 and the creation of your repayment plan. During this time, you need to pay at least enough towards your car loan to show you’re making an effort. The lender can also ask to have the automatic stay lifted. If successful, the lender could then go after your car. If your car was repossessed right before you filed for Chapter 13 bankruptcy, you might actually be able to get your car back. You would want to immediately discuss what to do with the qualified bankruptcy attorney helping you with your case.

No! When you file a Chapter 13 bankruptcy, an “automatic stay” will be issued by the bankruptcy court that stops most if not all debt collection efforts on qualifying debts, including repossession of your car. There is some lag time between when you file for Chapter 13 and the creation of your repayment plan. During this time, you need to pay at least enough towards your car loan to show you’re making an effort. The lender can also ask to have the automatic stay lifted. If successful, the lender could then go after your car. If your car was repossessed right before you filed for Chapter 13 bankruptcy, you might actually be able to get your car back. You would want to immediately discuss what to do with the qualified bankruptcy attorney helping you with your case.

Can I get a car loan in Chapter 13?

Yes! Once you have a confirmed payment plan in place, you might be eligible to work with specialized bankruptcy lenders who see your bankruptcy as a positive step to improve your situation. Keep in mind, however, that you will need to obtain written permission from the bankruptcy court through your bankruptcy trustee that allows you to incur new debt. The bankruptcy trustee will want to make sure you can afford any new debt within your court-approved payment plan. If your current car dies or is totaled in an accident that wasn’t your fault, the bankruptcy court understands you need a car and will work with you to make it happen. But the car you get will need to be one you can afford.

Yes! Once you have a confirmed payment plan in place, you might be eligible to work with specialized bankruptcy lenders who see your bankruptcy as a positive step to improve your situation. Keep in mind, however, that you will need to obtain written permission from the bankruptcy court through your bankruptcy trustee that allows you to incur new debt. The bankruptcy trustee will want to make sure you can afford any new debt within your court-approved payment plan. If your current car dies or is totaled in an accident that wasn’t your fault, the bankruptcy court understands you need a car and will work with you to make it happen. But the car you get will need to be one you can afford.

Can I get a car loan after chapter 13 discharge?

Yes! Because your credit score will still be low even after meeting the payment plan of your Chapter 13 bankruptcy, you’re best chance of being approved may be by applying for your loan with a bankruptcy car loan company. There will still be eligibility criteria you need to meet, and you’ll need to provide proof of your Chapter 13 discharge if it’s not already showing up on your credit report.

Yes! Because your credit score will still be low even after meeting the payment plan of your Chapter 13 bankruptcy, you’re best chance of being approved may be by applying for your loan with a bankruptcy car loan company. There will still be eligibility criteria you need to meet, and you’ll need to provide proof of your Chapter 13 discharge if it’s not already showing up on your credit report.

Can I keep my car if I file Chapter 13?

Yes! A Chapter 13 bankruptcy is designed to help you get caught up on payments for things like your car and house so you can keep them. The bankruptcy court will do what it can to reorganize and adjust your debts, such as getting interest rates reduced or having the principal decreased in order to give you a chance to get caught up over several years.

Yes! A Chapter 13 bankruptcy is designed to help you get caught up on payments for things like your car and house so you can keep them. The bankruptcy court will do what it can to reorganize and adjust your debts, such as getting interest rates reduced or having the principal decreased in order to give you a chance to get caught up over several years.

What happens to your car when you file chapter 13?

In a Chapter 13 bankruptcy, there are three basic options for what happens to your car, assuming you still owe money on a car loan for it. First, you can surrender it. When you do this, the car will be sold and applied towards the outstanding balance of your car loan. You still have to keep paying on what’s left, but it will now be considered unsecured debt, and in a Chapter 13 bankruptcy payment plan, you only end up paying back a portion of your unsecured debts based on what your income can handle, not the full amount. At the end of your payment plan all remaining unsecured debts are eliminated through the discharge process.

In a Chapter 13 bankruptcy, there are three basic options for what happens to your car, assuming you still owe money on a car loan for it. First, you can surrender it. When you do this, the car will be sold and applied towards the outstanding balance of your car loan. You still have to keep paying on what’s left, but it will now be considered unsecured debt, and in a Chapter 13 bankruptcy payment plan, you only end up paying back a portion of your unsecured debts based on what your income can handle, not the full amount. At the end of your payment plan all remaining unsecured debts are eliminated through the discharge process.

Second, you can get caught up on what you owe. If you’re several payments behind, then those can be lumped together and spread out over the course of your payment plan of 3-5 years. You still have to keep up your regular monthly loan payments, and then add the arrears amount on top of that, but because it’s spread out over several years, it’s usually a small enough amount that you can handle it.

Third, you might be able to “cram down” your car loan to eliminate negative equity. For example, if your car is worth $6,000 but you owe $10,000 on it, your principal could be “crammed down” to match what the car is worth ($6,000), which eliminates $4,000 of the debt. The new principal amount is then worked into your 3-5 year payment plan as part of your unsecured debt. But in a Chapter 13, you typically only end up paying back a percentage of your unsecured debts, and what’s left at the end of the payment plan will be wiped away. This means you’ll own your car free-and-clear when your Chapter 13 bankruptcy is discharged. Keep in mind, however, that recent car purchases don’t qualify for cram down. The purchase must have been made at least 910 days (about two-and-a-half years) before filing your Chapter 13 bankruptcy.

Can I sell my car while in Chapter 13?

Yes! You always have the option of selling your car at any time during your Chapter 13 bankruptcy. If selling the car doesn’t cover what you still owe on your car loan, then the remaining debt can be included as “unsecured debt” in your payment plan. You will end up paying some of what you owe based on your income, but probably not all of it. What’s left at the end of your payment plan will be wiped away in the bankruptcy discharge.

Yes! You always have the option of selling your car at any time during your Chapter 13 bankruptcy. If selling the car doesn’t cover what you still owe on your car loan, then the remaining debt can be included as “unsecured debt” in your payment plan. You will end up paying some of what you owe based on your income, but probably not all of it. What’s left at the end of your payment plan will be wiped away in the bankruptcy discharge.

General Common Bankruptcy Questions

What does bankruptcy do to your credit report?

Having a bankruptcy listed in your credit report acts like a big red flag to many creditors, who will see you as such a high-risk customer that they won’t extend you any credit at all. But there are also other lenders out there who view your bankruptcy as something positive you did to get your debts under control. Those lenders may be willing to give you a loan if you meet their eligibility requirements, although the rates and terms will not be as favorable as those enjoyed by customers without a bankruptcy in their credit history.

Having a bankruptcy listed in your credit report acts like a big red flag to many creditors, who will see you as such a high-risk customer that they won’t extend you any credit at all. But there are also other lenders out there who view your bankruptcy as something positive you did to get your debts under control. Those lenders may be willing to give you a loan if you meet their eligibility requirements, although the rates and terms will not be as favorable as those enjoyed by customers without a bankruptcy in their credit history.

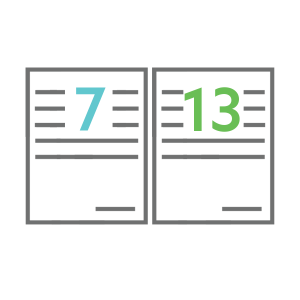

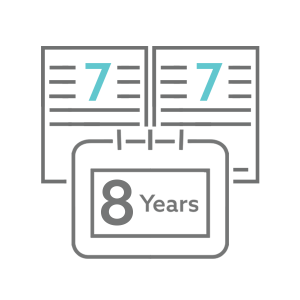

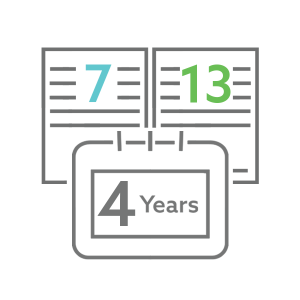

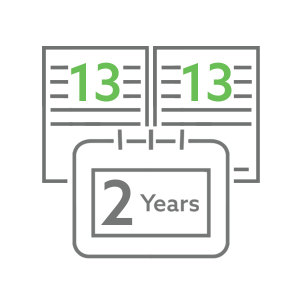

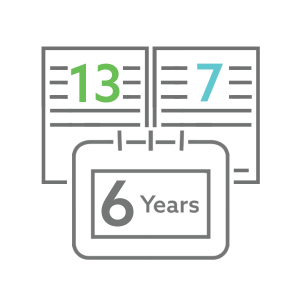

How long is bankruptcy on your credit report?

Whether you file for Chapter 7 or Chapter 13 bankruptcy, it will show up on your credit report. And it will stay there a long time. The public record of a bankruptcy stays on your credit report for 10 years from the date it was filed. But with a Chapter 13 bankruptcy, you can request the credit bureaus (Experian, TransUnion, and Equifax) to remove it after 7 years. The various accounts listed on your credit report that were affected by your bankruptcy stay on your credit report for 7 years from the time the account first went delinquent and was then never again brought current.

Whether you file for Chapter 7 or Chapter 13 bankruptcy, it will show up on your credit report. And it will stay there a long time. The public record of a bankruptcy stays on your credit report for 10 years from the date it was filed. But with a Chapter 13 bankruptcy, you can request the credit bureaus (Experian, TransUnion, and Equifax) to remove it after 7 years. The various accounts listed on your credit report that were affected by your bankruptcy stay on your credit report for 7 years from the time the account first went delinquent and was then never again brought current.

How do you remove bankruptcy from your credit report?

You cannot remove a legitimate bankruptcy from your credit report before the time allowed by the law, and any credit repair service who claims otherwise is telling you a lie. The removal of your bankruptcy from your credit report should happen automatically after 10 years from the date it was filed. If it was a Chapter 13 bankruptcy, you can ask the credit reporting agencies to remove it as early as 7 years after it was filed. This is a “reward” for having used Chapter 13 to pay back some of your debts. You should check the timing of when your bankruptcy was filed to make sure it really does get removed on time. If 10 years have passed since you filed bankruptcy and you’re still seeing it in your credit report, get in touch with the credit bureau and request that it be removed.

You cannot remove a legitimate bankruptcy from your credit report before the time allowed by the law, and any credit repair service who claims otherwise is telling you a lie. The removal of your bankruptcy from your credit report should happen automatically after 10 years from the date it was filed. If it was a Chapter 13 bankruptcy, you can ask the credit reporting agencies to remove it as early as 7 years after it was filed. This is a “reward” for having used Chapter 13 to pay back some of your debts. You should check the timing of when your bankruptcy was filed to make sure it really does get removed on time. If 10 years have passed since you filed bankruptcy and you’re still seeing it in your credit report, get in touch with the credit bureau and request that it be removed.

Questions About Day One Credit Bankruptcy Car Loans

If you find yourself needing a car when you have an open or recently discharged bankruptcy, Day One Credit is here to help! Here are some of the common bankruptcy questions people have specifically related to finding bankruptcy car financing through Day One Credit:

How soon can I get a new loan?

At Day One Credit, filling out our car loan application takes less than five minutes. And then you’ll have an answer from us in just minutes! We send your application out to our network of bankruptcy lenders and then choose the one that has the best rate and terms. When multiple lenders compete for your business, you’re the one who wins!

At Day One Credit, filling out our car loan application takes less than five minutes. And then you’ll have an answer from us in just minutes! We send your application out to our network of bankruptcy lenders and then choose the one that has the best rate and terms. When multiple lenders compete for your business, you’re the one who wins!

Do I have to wait until my bankruptcy is discharged?

No! A lot of people think there is some special period they have to wait before applying for a bankruptcy car loan. Whether it’s a Chapter 7 or a Chapter 13, you do not have to wait until your bankruptcy is discharged. As soon as you have a Chapter 7 case number or a Chapter 13 confirmed payment plan and permission from your bankruptcy trustee or judge, you are free to apply for bankruptcy car financing through Day One, provided you meet our eligibility requirements.

No! A lot of people think there is some special period they have to wait before applying for a bankruptcy car loan. Whether it’s a Chapter 7 or a Chapter 13, you do not have to wait until your bankruptcy is discharged. As soon as you have a Chapter 7 case number or a Chapter 13 confirmed payment plan and permission from your bankruptcy trustee or judge, you are free to apply for bankruptcy car financing through Day One, provided you meet our eligibility requirements.

If my bankruptcy is discharged, do I have to wait two years?

Many people have heard that lenders want to wait two whole years after a bankruptcy is discharged before they’ll consider making a loan to you. That may be true with many some lenders who see your bankruptcy as a negative and consider you too risky, but it is not true for the lenders who are part of the Day One network! If your bankruptcy was recently discharged and you meet our eligibility requirements, you are free to apply.

Many people have heard that lenders want to wait two whole years after a bankruptcy is discharged before they’ll consider making a loan to you. That may be true with many some lenders who see your bankruptcy as a negative and consider you too risky, but it is not true for the lenders who are part of the Day One network! If your bankruptcy was recently discharged and you meet our eligibility requirements, you are free to apply.

Do I have to put any money down?

Making a down payment when financing a car purchase is always a good idea if you can do it. But at Day One we understand that many of our customers simply can’t, which is why we do not require it. Many of the lenders in our specialized bankruptcy network have no-money-down programs to help you get the car you need.

Making a down payment when financing a car purchase is always a good idea if you can do it. But at Day One we understand that many of our customers simply can’t, which is why we do not require it. Many of the lenders in our specialized bankruptcy network have no-money-down programs to help you get the car you need.

What will be my payment?

We cannot predict ahead of time what your monthly payment will be. The amount of your payment depends on factors such as the price of the vehicle, your down payment (if any), the length of the loan, and the interest rate. These all become clear once you apply for a bankruptcy car loan through Day One and we send your application out to our network of lenders. They compete for your business and you end up with the loan that fits your situation.

We cannot predict ahead of time what your monthly payment will be. The amount of your payment depends on factors such as the price of the vehicle, your down payment (if any), the length of the loan, and the interest rate. These all become clear once you apply for a bankruptcy car loan through Day One and we send your application out to our network of lenders. They compete for your business and you end up with the loan that fits your situation.

What will be my APR?

Your interest rate and APR vary greatly because they depend on many factors, including your credit history, the vehicle’s age and condition, the length of the loan, and more. When you have an open or recently discharged bankruptcy, your APR will be higher than customers with good credit. But we work with many lenders and are able to secure the loan that fits your credit situation. If you meet our eligibility requirements, you can apply for a Day One bankruptcy car loan and see what kind of deal we can get for you.

Your interest rate and APR vary greatly because they depend on many factors, including your credit history, the vehicle’s age and condition, the length of the loan, and more. When you have an open or recently discharged bankruptcy, your APR will be higher than customers with good credit. But we work with many lenders and are able to secure the loan that fits your credit situation. If you meet our eligibility requirements, you can apply for a Day One bankruptcy car loan and see what kind of deal we can get for you.

Am I going to get a better rate if my bankruptcy is discharged?

This is hard to answer because it depends on what you did or didn’t do when your bankruptcy was an open case. If you took specific actions while your bankruptcy was open to improve your credit or save up money for a down payment, you might get a slightly better rate. But many people simply can’t wait to get the car they need, and waiting may not make much of any difference at all. In many cases, the best rates Day One can find for your bankruptcy car loan are when you apply before discharge, when the bankruptcy case is still open.

This is hard to answer because it depends on what you did or didn’t do when your bankruptcy was an open case. If you took specific actions while your bankruptcy was open to improve your credit or save up money for a down payment, you might get a slightly better rate. But many people simply can’t wait to get the car they need, and waiting may not make much of any difference at all. In many cases, the best rates Day One can find for your bankruptcy car loan are when you apply before discharge, when the bankruptcy case is still open.

What kind of car and amount financed I can get?

There are no restrictions on the type of car you buy, except that you have to be able to afford it! Affordability depends on your payment-to-income and debt-to-income ratios, which are what lenders look at when evaluating your application. For most bankruptcy customers, what makes the most sense is to look at newer used cars with low miles that are in great shape. You get more bang for your buck and will have an easier time affording a good used car. New cars are so expensive these days that they’re often not a realistic option for bankruptcy customers.

There are no restrictions on the type of car you buy, except that you have to be able to afford it! Affordability depends on your payment-to-income and debt-to-income ratios, which are what lenders look at when evaluating your application. For most bankruptcy customers, what makes the most sense is to look at newer used cars with low miles that are in great shape. You get more bang for your buck and will have an easier time affording a good used car. New cars are so expensive these days that they’re often not a realistic option for bankruptcy customers.

What is going to happen with my old car?

If you still have a car, Day One will give you a fair trade-in value for it, which will help you get your next ride! And if you still owe money on a car loan for it, we can help you figure out the best course of action.

If you still have a car, Day One will give you a fair trade-in value for it, which will help you get your next ride! And if you still owe money on a car loan for it, we can help you figure out the best course of action.

If I signed a reaffirmation agreement can I still get a new loan?

Yes, you can! When you signed a reaffirmation agreement, all it meant was that you were committing yourself to continued payments on your vehicle’s loan. But you still have the freedom to sell that vehicle and get another if you can qualify for the new loan. That may be difficult if you owe more on your vehicle than it’s worth (being “underwater” or “upside-down” on the loan), but we’ve successfully helped many customers with this exact situation.

Yes, you can! When you signed a reaffirmation agreement, all it meant was that you were committing yourself to continued payments on your vehicle’s loan. But you still have the freedom to sell that vehicle and get another if you can qualify for the new loan. That may be difficult if you owe more on your vehicle than it’s worth (being “underwater” or “upside-down” on the loan), but we’ve successfully helped many customers with this exact situation.

Can I get out my current underwater car loan?

Yes! This is another possibility when going through bankruptcy. It is always best to discuss your options with an experienced bankruptcy attorney.

Yes! This is another possibility when going through bankruptcy. It is always best to discuss your options with an experienced bankruptcy attorney.

Now that you know the answers to many of the common bankruptcy questions as they relate to your car and financing a car purchase with a bankruptcy car loan, we invite you to explore the Why Day One page to see what we can do for you. If you still have any questions, please feel free to contact us. And if you’re ready, go ahead and apply now!

At Day One Credit we are experts at finding the best possible bankruptcy car loans in order to help our customers purchase high-quality used cars. We are not lawyers, we do not give legal advice, and nothing we say should be taken as legal advice. Your first step in anything related to bankruptcy should always be seeking the advice and counsel of a qualified bankruptcy attorney.